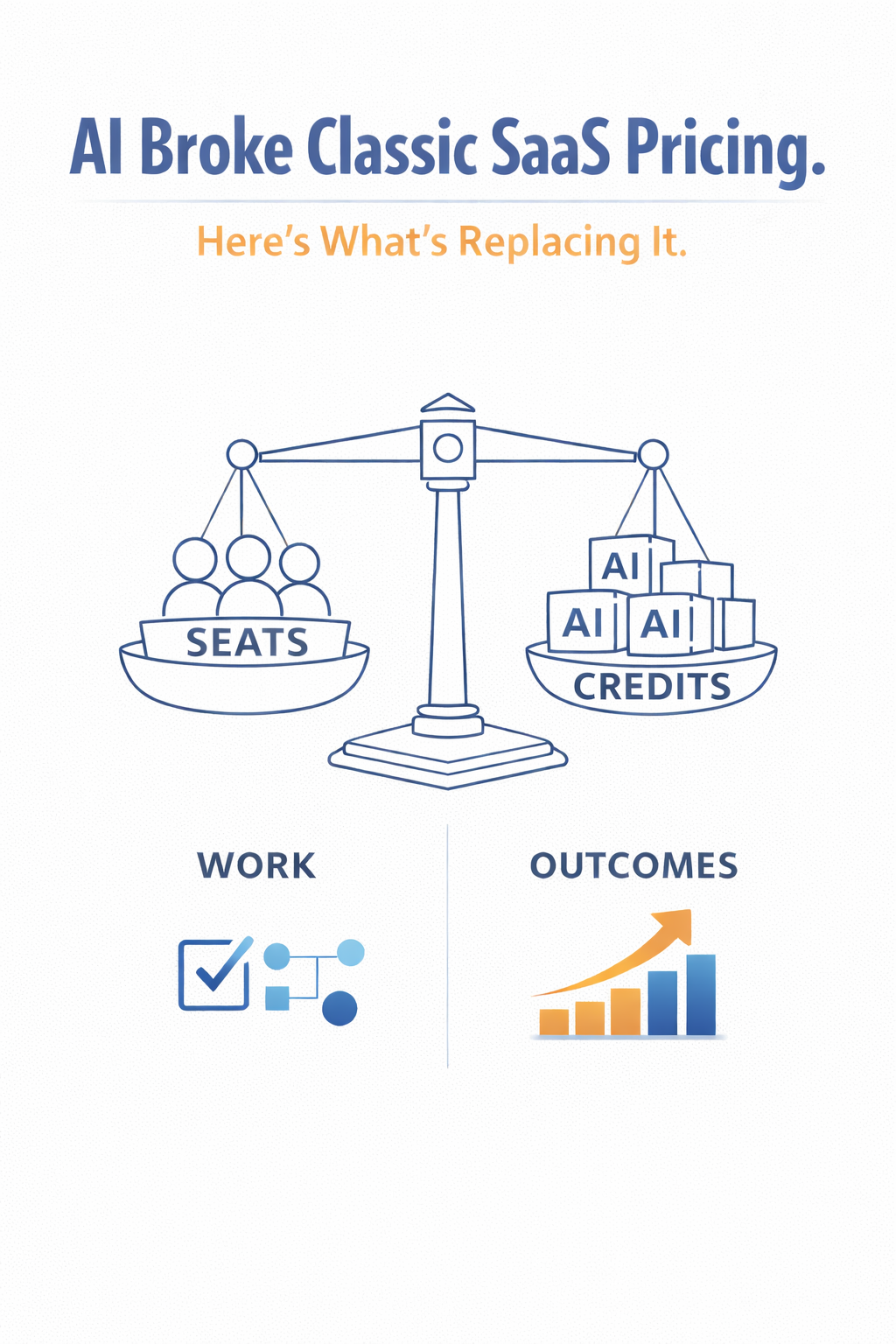

AI Broke Classic SaaS Pricing. Here’s What’s Replacing It.

SaaS is evolving fast. From the investor seat, one pattern keeps showing up: classic SaaS pricing breaks in AI. Founders are adapting with new business models, and we’re learning from those experiments in real time.

As a VC, Your Edge Isn’t Only Your Network! It’s Also Your Learning Rate

Everyone has access to the same headlines. The real difference is who upgrades their mental models fast enough to recognize what matters, before it gets packaged into a narrative, turned into a buzzword, and priced in.

New Asset Class: Cashflow Capital

Venture capital trained us to see the startup world in two buckets: “lifestyle” versus “high growth.” That two-bucket model used to be helpful. Now it’s limiting. Not because VC is wrong, but because technology is changing the shape of what a “good company” looks like. The future isn’t only unicorns. It’s also upgraded “lifestyle” businesses that distribute cash, as AI makes software cheaper.

How Much Should You Actually Own In Portfolio Companies? A Practical Guide to VC Ownership

In venture capital, one phrase shows up in almost every partner meeting: “What’s our ownership?” For years, VCs have been trained to think that if you don’t own 10–20%, you’re not really in the deal. But is that always true? And in a world of larger rounds, competitive syndicates, secondaries, and multi-asset strategies… how much should a VC really care about ownership %?

The Lifecycle of a VC’s Ego: The Humbling Journey of Venture Capital

There’s a lot written about the lifecycle of a startup, the lifecycle of a fund, even the lifecycle of a market. Almost nobody talks about the lifecycle of a VC’s ego.

This is my attempt to map that journey, not as a therapist, not as a guru, but as someone who has lived through most of these stages personally.