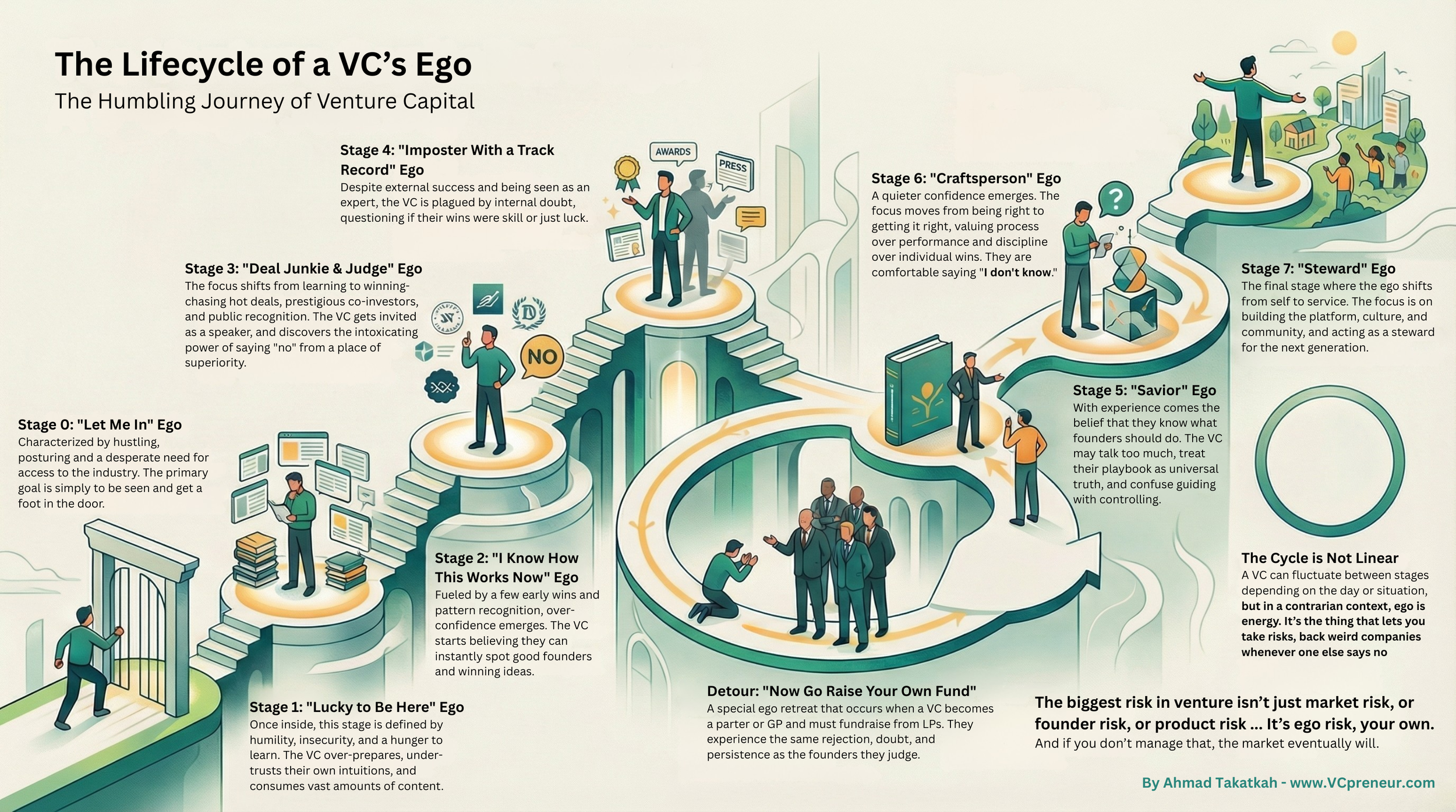

The Lifecycle of a VC’s Ego: The Humbling Journey of Venture Capital

The Lifecycle of a VC’s Ego: The Humbling Journey of Venture Capital

There’s a lot written about the lifecycle of a startup, the lifecycle of a fund, even the lifecycle of a market.

Almost nobody talks about the lifecycle of a VC’s ego.

After 15+ years in venture, I can tell you this: the fund evolves, the market evolves, but your ego probably evolves faster than anything else. It’s one of the main hidden variables behind your decisions, your relationships with founders, LPs, other VCs and angel investors, and how long you actually survive in this game.

This is my attempt to map that journey, not as a therapist, not as a guru, but as someone who has lived through most of these stages personally.

Stage 0: The “Let Me In” Ego

(Hustling, posturing, trying to be seen)

Before you’re even a VC, your ego is already on the field.

You’re trying to “break in”:

Trying to meet the right partners and “connect with people in the industry.

Scouting deals for other firms just to be useful.

Volunteering to help with due diligence, research, anything.

Saying yes to every coffee and event because somewhere in that room is your shot.

You’re both humble and performative:

You’re hungry to learn, but also desperate to look smart.

You want to impress the very people whose jobs you don’t fully understand yet.

You replay conversations in your head, wondering if you sounded “VC enough.”

At this point, your ego wants one thing: access.

Stage 1: The “Lucky to Be Here” Ego

(Humble, insecure, hungry)

You finally get in.

You’re officially “in venture,” but inside you still feel like you snuck in through the back door. You over-prepare for every meeting. You take obsessive notes. You say “great question” to every partner comment because you’re terrified of looking dumb.

At this stage, the ego is small but loud:

You don’t think of yourself as a capital allocator yet.

You stay too quiet in founder meetings even when you see real issues.

You over-respect “experience” and under-trust your own instincts.

This is also when the content binge begins:

You read every VC book you can find.

You listen to all the podcasts.

You subscribe to every newsletter.

You follow the news like your life depends on it.

You’re hungry to learn, and you measure your progress by how much content you consume.

That learning is good… until your brain quietly shifts from:

“I know nothing,”

to

“I’ve seen this movie before.”

That’s when the next stage sneaks up on you.

Stage 2: The “I Know How This Works Now” Ego

(Pattern recognition + overconfidence)

Then, something dangerous happens: a few deals go right. You’ve consumed all the “right” books and podcasts. You start recognizing patterns and you start believing those patterns are truth.

You catch yourself thinking:

“Good founders sound like this.”

“Bad founders talk like that.”

“This market is obviously too small.”

“This is like X unicorn, but in a new geography/vertical. Easy.”

Your ego grows faster than your actual track record.

You fall in love with your own “taste.” You think you can skim a deck in five minutes and know the answer. You start interrupting founders with:

“Let me guess, you’re going to monetize by…”

This is the Illusion of Mastery phase:

You’ve read all the content.

You’ve seen a few outcomes.

You feel like you “get it” now.

But you don’t yet appreciate how expensive being wrong is in this asset class.

Stage 3: The “Deal Junkie & Judge” Ego

(Chasing logos, loving the power of ‘no’)

At some point, your ego starts to care less about learning and more about winning and judging.

Winning conversations.

Winning deals.

Winning allocations.

Winning brand points.

You want:

Hot rounds with oversubscribed caps.

Big-name co-investors.

Logos you can brag about on your website and LinkedIn.

Mentions in the press.

And just when your internal judge is peaking, the external validation kicks in.

You start getting invited to panels, demo days, podcasts, conferences. People introduce you as “an expert in X.” You say yes to everything at first. You start to enjoy the sound of your own voice, the feeling that people are writing down your opinions as if they’re rules. A small but dangerous thought creeps in: maybe I’m the guru everyone should listen to.

And at the same time, you discover a new drug: the power of saying no.

It’s easy and intoxicating to:

Be the critic in the room.

Tear decks apart in two minutes.

Say “no” from a place of superiority instead of thoughtful underwriting.

You get snobby with founders:

You roll your eyes (internally) at “naive” assumptions.

You dismiss ideas because they're not following the “new trendy tech wave”, or they don’t match the pattern you created in your mind.

You dismiss people because they don’t sound like your mental model of a great founder.

You say no quickly and feel smart about it.

It feels safe. It feels rational. But then reality hits.

You start seeing:

The market turns, and you start seeing down rounds.

One of your “perfect” upcoming deals blows up.

“Obvious unicorns” in your portfolio quietly die.

Companies you passed on raise big rounds and succeed.

Your anti-portfolio screenshots look better than your portfolio.

New trends come up and you didn't see them coming!

Your own pattern recognition is challenged.

Suddenly the narrative in your head (“I’m the guru now”) doesn’t match the outcomes on your cap table.

That’s when a painful truth lands:

In venture, “no” is as expensive as “yes.”

Every pass is a decision with a price tag attached. You just don’t see the bill until years later.

This is when the ego takes its first big hit.

Stage 4: The “Imposter With a Track Record” Ego

(Internal doubt vs external perception)

By now, some of your early bets have matured. You have both wins and losses. People introduce you as “experienced.” You start getting DMs from junior investors asking for advice.

Externally, you look like:

“One of the OGs in the ecosystem.”

Internally, you’re asking:

“Am I actually good at this?”

“Was I just lucky?”

“If I’m so smart, why did I miss that company and back this one?”

Your ego splits:

One side clings to the expert image.

The other side feels like an imposter who sees how random and messy this game truly is.

If you don’t handle this stage well, you either:

Double down on pretending you know everything (and become rigid, cynical, or arrogant), or

Collapse into self-doubt and second-guess every decision.

Detour: The “Now Go Raise Your Own Fund” Humbling

(Becoming a partner / GP and feeling the founder pain)

There’s a special ego shock that deserves its own section: the first time you step into fundraising as a partner or GP.

Maybe you:

Become a partner and join the fundraise roadshow.

Spin out and start your own fund.

Launch a new vehicle where you are the product.

Suddenly, you’re not just the person judging decks, you’re the one being judged.

You now:

Pitch LPs who ghost you, just like founders get ghosted.

Hear “you’re too early / too late / too small / too niche” on repeat.

Realize how abstract “track record” becomes when it meets actual risk appetite.

You taste the same cocktail founders drink every day:

Hope, rejection, doubt, persistence, humiliation, resilience.

This is one of the most humbling ego resets in a VC’s life:

You finally feel, in your bones, that you’re not above founders, you’re one of them.

Stage 5: The “Savior” Ego

(Believing you’re the main character in founders’ stories)

As you accumulate experience, sit on more boards, and watch more companies live and die, another ego mutation shows up: the Savior.

You’ve seen patterns. You’ve seen mistakes. You’ve seen what good looks like. You start to believe you know what founders should do.

So you:

Talk too much in board meetings.

Treat your playbook as universal truth.

Take too much credit when things go right.

Blame “execution” when your thesis was wrong.

Your ego whispers:

“If they just listened to me, this company would be fine.”

The problem: you are not the protagonist, or the main character, or the hero.

The founder is.

You’re important, but you’re a supporting character in their story, not the hero. When the savior ego takes over, you might:

Push founders toward what makes you comfortable.

Make them manage your anxiety instead of their company.

Confuse “guiding” with “controlling.”

Stage 6: The “Craftsperson” Ego

(Quiet confidence, process over performance)

If you survive long enough, and stay self-aware enough, your relationship with your ego softens.

You stop needing to be:

The smartest person in the room.

The loudest voice on the board.

The one with the hottest deals.

You start caring less about being right and more about getting it right. You start trying to find the people who challenge your own assumptions, and love being around those who are smarter than you.

Your ego becomes calmer:

You’re comfortable saying, “I don’t know.”

You ask more questions than you give speeches.

You focus on your edge instead of pretending to have one everywhere.

You judge yourself less on individual deals and more on your discipline over cycles.

You move from:

“Look at my deals,”

to

“Look at my process.”

Venture finally feels like a craft:

You refine how you source, evaluate, and support.

You become clearer on what’s in your circle of competence.

You learn to say “no” without ego and “yes” without drama.

Stage 7: The “Steward” Ego

(From ‘my brand’ to ‘our platform’)

The final stage, if we ever truly reach it, is when your ego shifts from self to stewardship.

You think less about:

“How big is my carry?”

“How do I look on stage?”

“What’s my personal brand?”

And more about:

“What kind of platform are we building?”

“What true value-add we’re bringing?"

“What culture are we seeding?"

“What community are we creating or joining?"

“How do we behave when markets are down?”

“How do we behave when we make mistakes?”

“What norms am I reinforcing for the next generation of GPs and founders?”

“What content can I produce to truely add value, not to promote myself?”

You start to see:

Your reputation as infrastructure, not a trophy.

LP capital as something sacred, not just fuel.

Founder relationships as decades-long, not deal-long.

Your ego doesn’t disappear. It re-orients:

Protective of the craft.

Protective of the platform.

Protective of the culture.

Protective of the community.

Protective of the next generation.

The Cycle Never Really Ends

I’d love to say this is a clean, linear journey. It’s not.

On a good day, I’m in the craftsperson or steward stage.

On a bad day, I can slip back into deal junkie, critic, or savior mode.

The point isn’t to “kill” the ego. You can’t, and you shouldn’t. In a contrarian context, ego is energy. It’s the thing that lets you take risks, back weird companies whenever one else says no, and still show up after painful losses.

The real work is to:

Notice which version of your ego is driving the decision.

Build partners, LPs, and founders around you who keep you honest.

Remember that “no” can be as costly as “yes,” and that you’re not above the game, you’re inside it.

After 15+ years in VC, I’ve learned this:

The biggest risk in venture isn’t just market risk or founder risk or product risk ...

It’s ego risk, your own.

And if you don’t manage that, the market eventually will.